🕹️ The Deals That Defined Gaming: The Roblox DPO

Gaming’s largest public offering wasn’t an IPO, it was a DPO.

The Deals That Defined Gaming is a series analyzing the investments, acquisitions, and capital plays that reshaped the power structures of the game industry and the people, incentives, and timing that made them happen.

This is the companion article to previous article: Slaying the Incumbent: Roblox

In 2020 I made the ill-fated decision to go to business school under the guise that I wanted to become a bulge-bracket investment banker in the TMT industry groups. I somehow tricked Goldman Sachs SF and Morgan Stanley Menlo Park to bring me to their super days and when I was not absolutely bombing the interviews, I kept bringing up Roblox’s upcoming planned public listing valuation and how they achieved such a high multiple. Roblox, the low-fidelity UGC platform that few in traditional publishing circles took seriously, was going public at an estimated valuation over $40 billion? That dwarfs the valuation of the largest video game IPOs and M&As up to that point. Although a life of wearing suits and 3am bedtimes wasn’t in the cards for me, I still wonder how Roblox seemingly came out of nowhere to execute the largest public listing in video game history.

How did Roblox achieve such a high revenue multiple in its valuation? What were the comps for Roblox? Was the valuation justified? Does a game company need to be profitable? What is a Direct Public Offering (DPO) and why did Roblox opt for that over a traditional Initial Public Offering (IPO)?

The Lead-Up

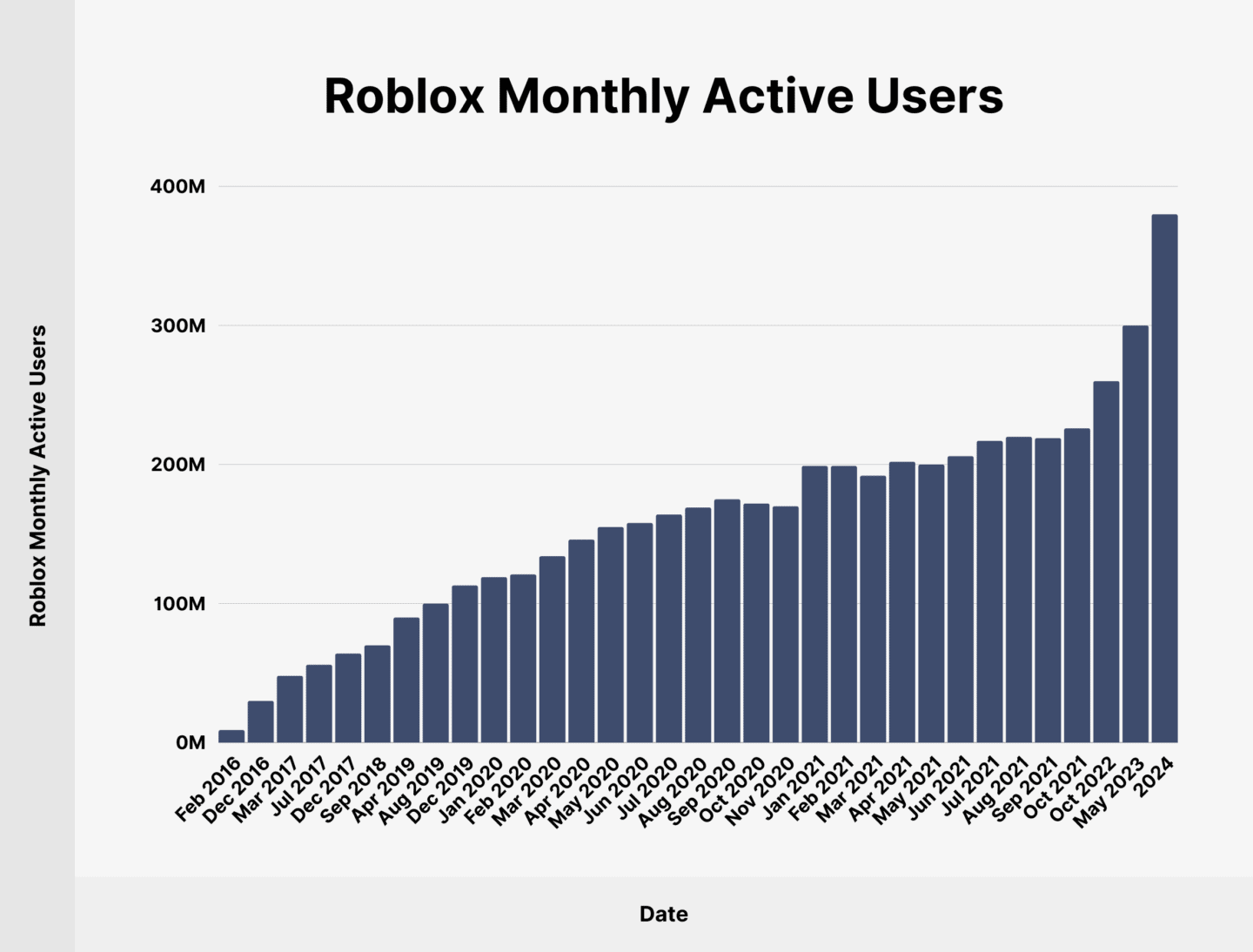

After the slowburn of finding product-market-fit, Roblox really started to take off by the end of 2016 reaching 30 million monthly-active-users (MAU). This was a combination of building out a proper developer studio (Roblox Studio), enhancing the underlying engine, and retaining developers through the Developer Exchange allowing for real-world payouts and virtual economy stability.

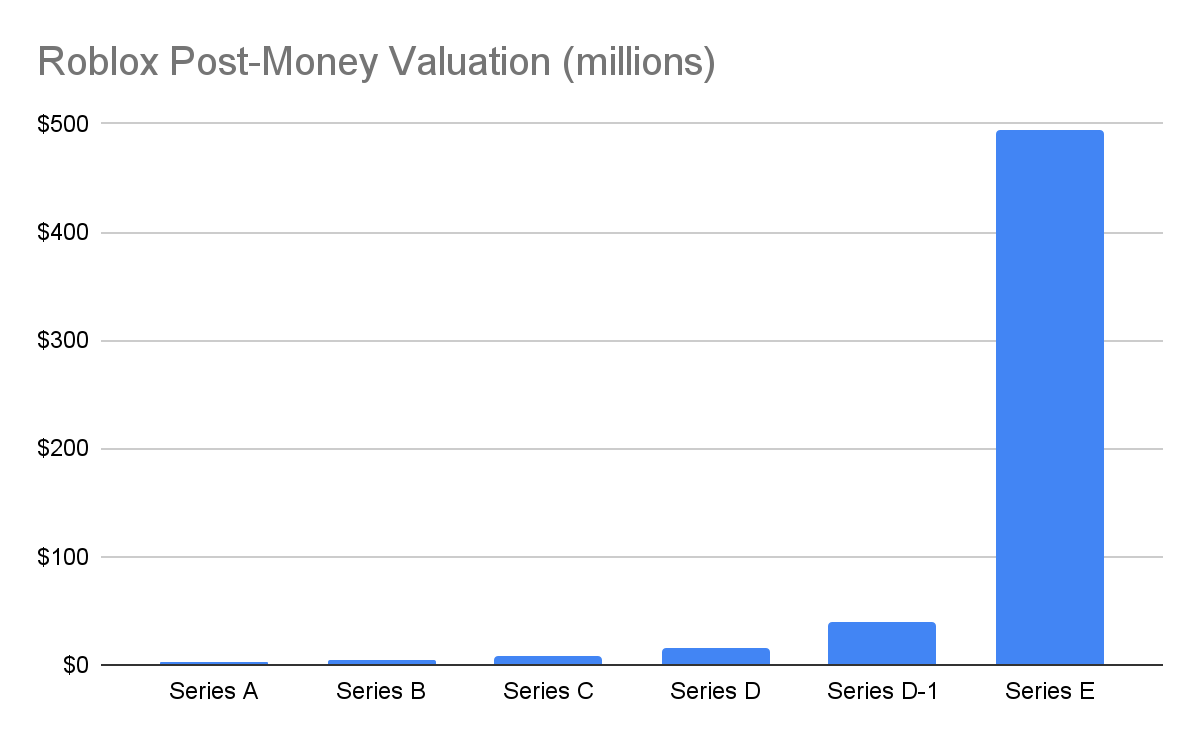

Pre-DPO, Roblox had raised over $855 million in fundraising from their Series A in 2005 all the way to their Series H in 2021. The anomaly round was the Series E in 2017. After a 6 year gap in fundraising, Roblox raises a round at over a 10x post-money valuation from solidifying its flywheel and changing the narrative from “Roblox is a game with user created levels” to “Roblox is a UGC platform with proprietary internal tooling, multiple monetization systems, and a full fledged creator economy”. The platform transformation exploded Roblox’s MAU from 6.8 million in 2011 to 30 million in 2016. This was the beginning of their growth run that would last through the DPO.

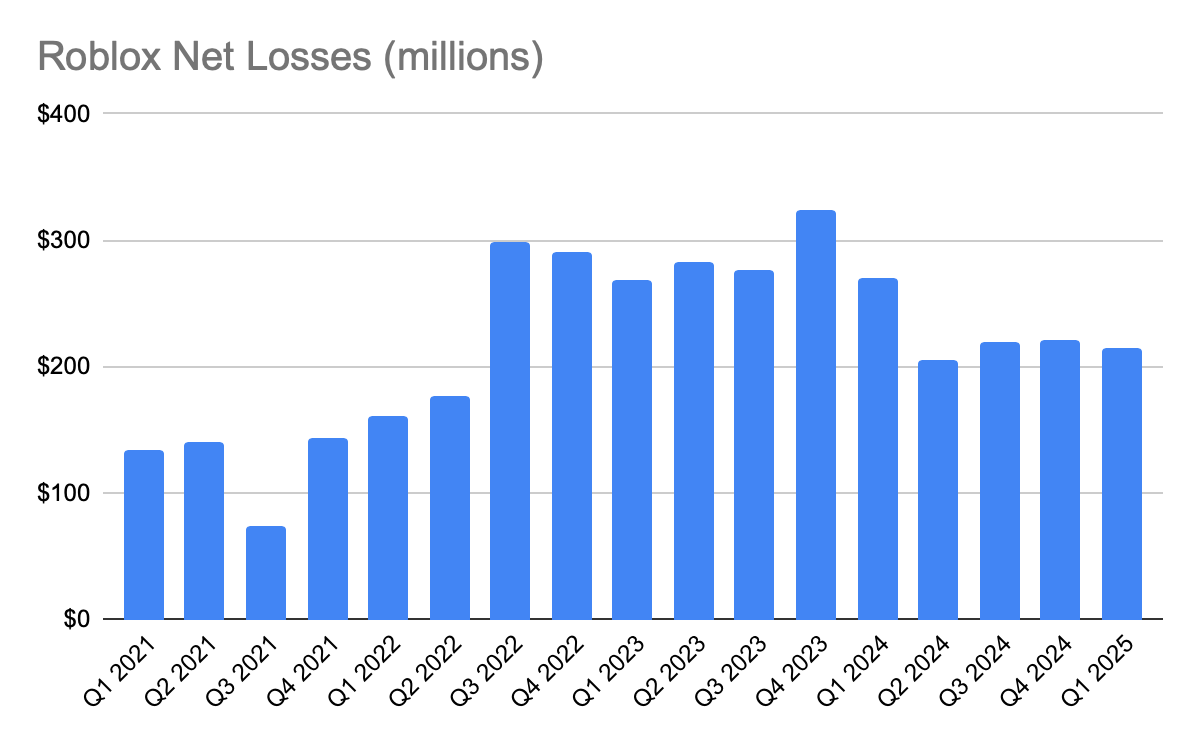

There were a few factors that led to a decision to go public. First, private capital, VC and PE firms, were growing impatient with their investment in Roblox. Generally, VC firms are expected to return capital from funds raised on a 10 year scale. Another factor was Roblox’s mounting quarterly losses. Roblox has never turned in a profitable quarter and their losses scale with active users and engagement, which were both on a meteoric rise at the time. Finally, Roblox’s deep moats of a proprietary engine and tools, developers earning meaningful revenue, and the flywheel of converting players to creators were paying off and Roblox was snowballing active users to becoming the biggest game of all time.

https://backlinko.com/roblox-users

Finally, we have to talk about COVID-19. While it accelerated the growth of the entire game industry, Roblox may have sustained this growth more than any other game and became the king of blackhole games, enveloping players and not letting them escape. Roblox’s momentum during the first year of COVID was historic and Roblox had never looked as attractive to institutional investors as it did by the end of 2020.

The Deal Itself

Roblox ended up not having an Initial Public Offering (IPO) but instead opted for a Direct Public Offering (DPO). In a traditional IPO, a firm hires a bulge bracket investment bank as an underwriter, they file an S-1 with the SEC, executives go on a roadshow to build demand with investors, the firm issues new shares for the underwriter to sell to the public, finally the underwriter sells the newly issued shares to institutional and retail investors on secondary markets.

In a DPO, the firm does not issue new shares but instead shareholders list their existing shares on secondary markets. The firm does hire an advisor and files an S-1, but there is no roadshow or underwriter before the shares hit the secondary markets. Roblox opted for a DPO to provide liquidity for early employees and investors. Also with a DPO, Roblox would not have to issue new shares, diluting existing shareholders, or pay the underwriter through the spread between the price the underwriter pays and the price the initial offering is set at, typically between 5% to 8%.

Unlike an IPO where a price discovery process takes place, during a DPO the company sets a reference price. That reference price is a guide or suggestion as to what the shares could price at upon market open, as the actual price is determined by existing shareholders selling and buyers interested in purchasing. At the end of the first day of listing, Roblox closed with a market cap of $45.2 billion, $15.7 billion above their Series H valuation 6-months prior.

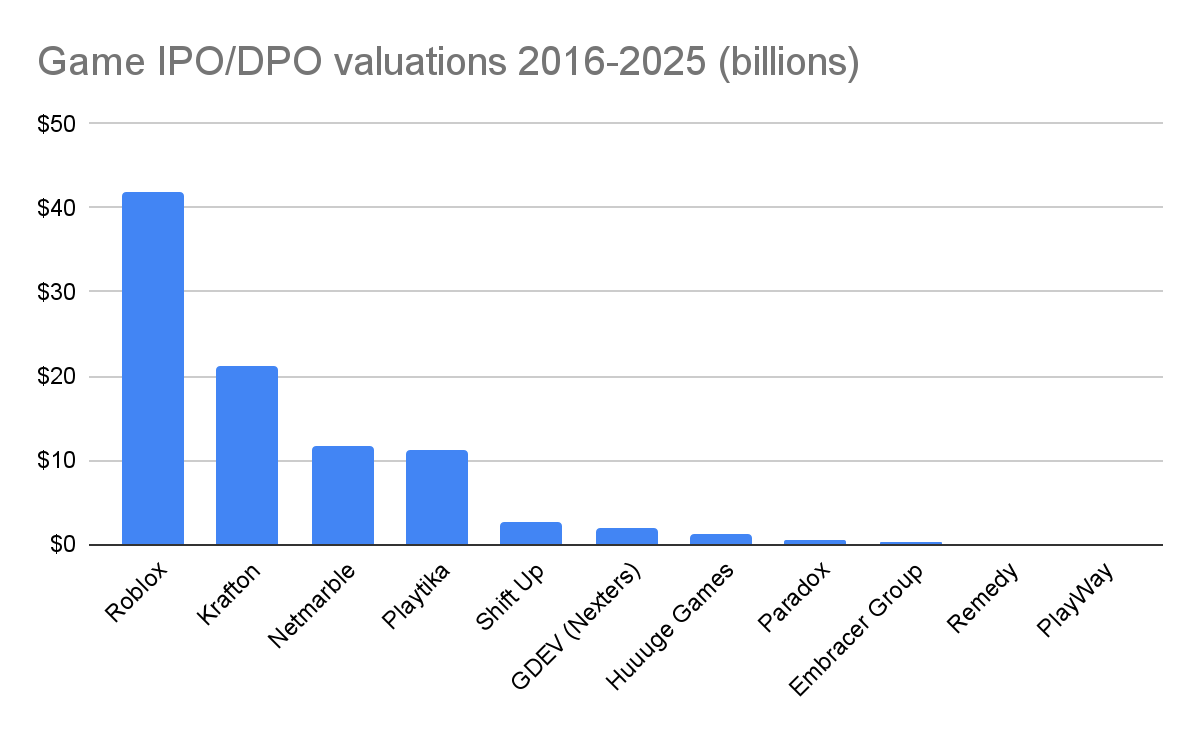

Comparing Roblox to the few game industry IPOs in the years surrounding its DPOs, with M&A still being the preferred exit in the game industry, shows Roblox’s valuation towering over mega-hit developers, rollup umbrella companies, major mobile publishers, and award winning independent developers. Why do you think that is? Roblox isn’t being compared to other game companies for growth metrics, it’s being compared to SaaS companies, social networks, and online marketplaces. Game developer and publisher valuations are beholden to the quality of their content or at best, their content’s ability to retain users in their live service games. With a platform, content is developed by creators and incentivised by consumers. Once a platform like Roblox solves the cold start problem, the challenge of launching a platform that relies on both creators and users without having either at the beginning, their growth can be explosive while incurring much lower cost-per-content than traditional developers. The market fully understands this and values Roblox as a platform that has solved this most difficult problem and is now scaling to unknown heights.

Roblox’s 2020 revenue, the year before the DPO, was $923.89 million yet when Roblox DPO’d in 2021 they garnered a 50 times multiple for their valuation. Roblox’s closest peer is Unity’s 2020 IPO, garnering Unity a 25 times multiple for previous year’s revenue. On top of being awarded platform multiples, Roblox’s revenue nearly doubled between 2019 and 2020. The final piece to the massive multiple awarded to Roblox is that Roblox provided one of the earlier exposure for public market investors to the Gen Z audience. Roblox was the Gen Z proxy on the public market.

What Happened Next

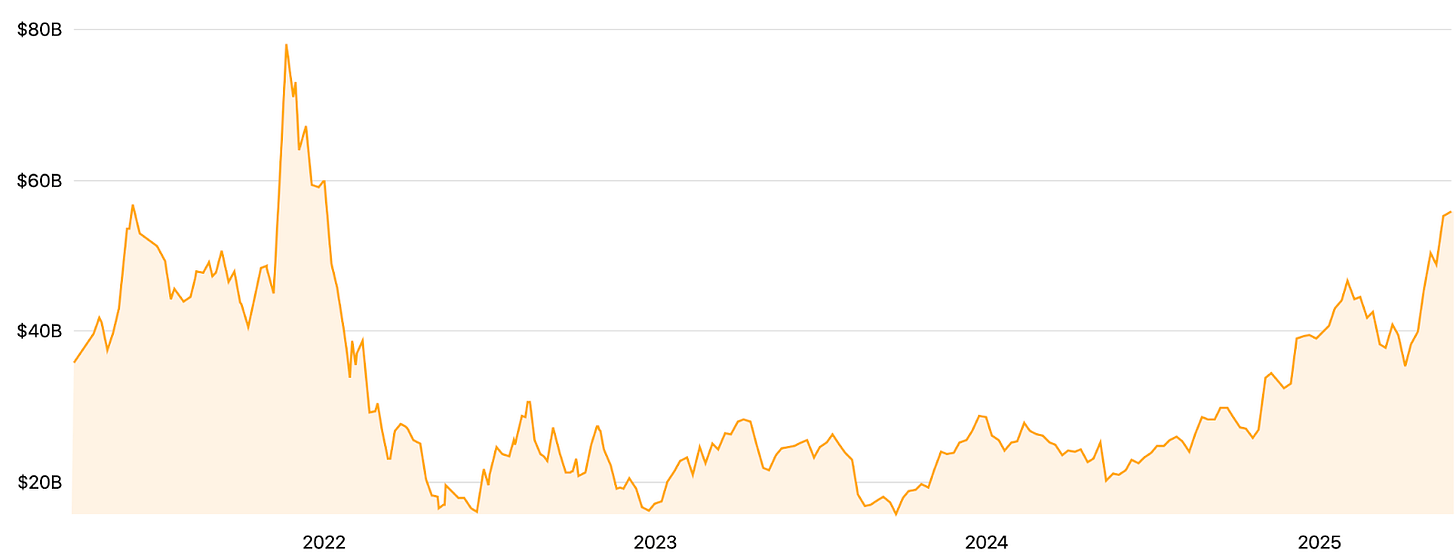

Roblox’s narrative was attached to Facebook’s 2021 rebrand to Meta and all the metaverse hype by the market. Roblox became a proxy for metaverse enthusiasm in the public markets, often lumped into ETF holdings or analyst reports alongside Meta post-rebrand. This sent its stock on a rollercoaster until settling in late 2022 under the guise that Gen Z was aging out and Roblox’s growth didn’t pan out to justify it’s massive DPO valuation. From then Roblox quietly strengthened its moats, broadened its playerbase, and retained top game developers on its platform. The market took notice in 2025 when growth led to the platform reaching a record 380 million MAU through compounding retention, and the stock started to recover.

Roblox market cap 2021-2025

Institutional investors poured into Roblox through the secondary markets. As of today, top shareholders are the who's who of investment firms from Vanguard to Blackrock, mostly as a by-product of indexing or balancing investment products such as ETFs. Roblox has the benefit that the largest institutional investors help stabilize Roblox’s stock by holding large blocks and trading less often than retail investors. This investor mix signals that Roblox is treated not as a high-risk growth story, but as a credible blue-chip long hold within the Gen Alpha and Gen Z tech index.

The final post-DPO story is Roblox’s profitability or lack thereof. Roblox has never had a profitable quarter since its DPO, with losses averaging $217 million per quarter. Roblox faces rising costs as it re-invest revenue into developer tools to compete with game engines (Unity, Unreal), drives player retention away from other platforms (Steam, iOS), and pays out rising developer revenue shares to keep top creators within its ecosystem. Trading off profits for reinvestment is not an unusual strategy for platforms in their growth stage such as Amazon in the 2000s. At an estimated 380 million MAU (Coolest Gadgets), questions about how high its audience can grow raise concerns about its active user growth story and with the metaverse no longer looking like a near reality, Roblox’s earnings rely on driving transaction for its user base higher than ever to offset their spend.

Roblox’s net losses didn’t scare institutional investors away for the same reason Tesla’s or Amazon’s didn’t in their early years, they were building long-term moats not harvesting short-term profits. Like Amazon investing in logistics or Tesla investing in battery scale, Roblox is building a creator economy flywheel that compounds value over time. It’s a platform bet, not a product bet and the public markets gave Roblox a multiple in line with SaaS not traditional gaming publishers. In the platform framing, $900 million in quarterly revenue with $250 million in quarterly losses isn’t failure, it’s deferred margin in exchange for creator lock-in and user retention.

Impact on the Industry

Roblox’s direct listing is the largest public offering in video game history, dwarfing the IPOs throughout the history of video games. Roblox’s dominant platform strategy is rewarded by the public markets, paving the way for other video game firms to develop their own flywheel to receive generous revenue multiples in their valuations. Future studios can’t just IPO and expect a great valuation because they develop great games, they need to meaningfully implement strategies from enterprise SaaS, social media, and online marketplaces. Investors increasingly ask “What’s your flywheel?” or “What’s your creator economy?”.

This explains the rise of UGC infrastructure platforms like Overwolf, mod.io, and even Fortnite Creative’s expansion into economy tools. Roblox proved UGC can be a platform not just a feature within a game and Roblox’s DPO proved that investors reward long term thinking with delayed returns within the game industry.

Lessons & Takeaways

Roblox made game industry valuation history by not building a better game or shipping a more polished product, but by creating a platform with defensibility, scalability, and ultimately monopoly economics. Developing a platform takes time and fundraising with Roblox raising over $850 million in 9 rounds over 16 years before returning capital to investors. With the success of Roblox’s DPO, investors have a benchmark for making long term bets on platforms. Roblox was afforded nearly 10 years to refine their product-market-fit while most game development studios are funded for one, maybe two games before they are uninvestable. Following in Fortnite’s footsteps, expect more of the largest games-as-a-service products to emerge with two sided platform-like structures.