Xbox Layoffs Show How Player Habits Broke Game Funding

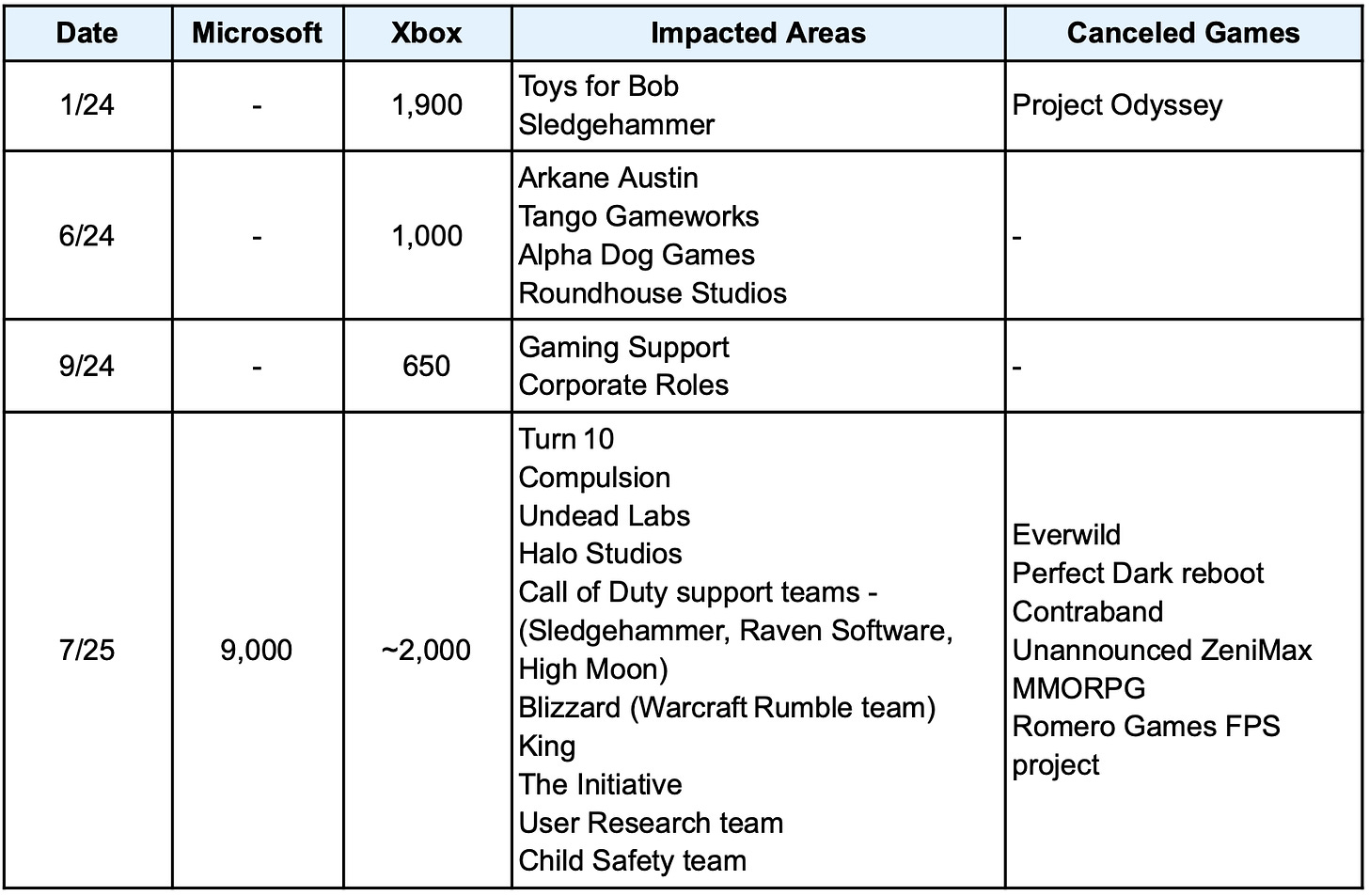

The Xbox layoffs weren’t about bad management or greedy shareholders, they were proof that player habits broke game funding. In early July we saw the all too familiar headline: Microsoft is laying off 9,000 employees. After years of forming and acquiring game studios, the crown jewel of which was the $69B acquisition of Activision-Blizzard-King, Xbox is having their 3rd major layoff in 18 months.

When Phil Spencer, the CEO of Xbox, announced “Our platform, hardware, and game roadmap have never looked stronger” during the recent July layoffs, the normal storm of outrage, anger and memes filled the internet as gamers and developers alike looked at Xbox as greedy overlords who canceled their hyped upcoming games and slashed roles in the name of profit maximization.

In a way, Microsoft is the main character for the transition the game industry is undergoing. After decades of consistent growth, the game industry received a once-in-a-generation growth acceleration from the 2020 COVID-19 lockdowns, which in turn caused a massive influx of investments into games aided by the incredibly low Fed interest rates. In 2024, suddenly those investments looked like liabilities and managers started cutting their losses.

But to find the underlying issue of why the video game industry is so tough in 2025, we’ll have to start with the biggest symptom: the July Microsoft layoffs.

Microsoft

The question to kick off this investigation: Is Microsoft a bad publisher?

A great question to ask is whether the game studios and consumers are worse off with Microsoft owning these studios. Although Microsoft has a questionable legacy of managing acquired studios (Ensemble, Lionhead), the best candidate to answer this question is none other than RPG heavy hitter Bethesda. Created in 1986, acquired by Microsoft in 2021, Bethesda is a publishing juggernaut known for the Elder Scrolls, Fallout, and Doom series. Bethesda gives us a good post-acquisition runway to compare to the legacy independent publisher performance.

First, let’s look at the release rate pre- and post-acquisition.

There is certainly a drop in output but nothing particularly alarming; the mainline game output is similar pre- and post-acquisition. Another strawman argument is to point at Redfall and Starfield as indicators of Microsoft’s poor leadership leading to quality drop-offs, except we have the woefully executed Fallout 76 (52 Metascore and 28 User Score) and the launch performance of Deathloop (Arkane’s worst-performing UK launch) as pre-acquisition missteps.

The argument for Microsoft is Xbox leadership greenlighting 9-figure games only to cancel them. There is a business reality to the layoffs from acquisitions, the cost incentives of acquiring and owning multiple game studios is in the central functions (HR, IT, Tech Ops, marketing, etc) and the diversification required by an independent studio is not the same diversification needed by a top 5 worldwide publishers. Laying off non-development staff and non-mainline games, as horrible as it sounds, is the alpha in acquiring and operating a group of game studios. If you want to direct hate for those layoffs, throw it at the leadership and shareholders of the acquired studios for accepting the buyout knowing layoffs were an inevitability for their staff.

If laying off non-development roles is given a pass approval solely from the reality of generating value from acquisitions, giving Xbox leadership a pass on greenlighting 9-figure games only to cancel them a few years later is more of a grey area. AAA game development is a long, arduous process. The entertainment industries move at a breakneck pace and a lot can change in the 5+ year development most AAA games require between conception greenlight and launch. What made sense during the mega-growth years of 2020-2022 no longer makes sense in the market realities of 2025. Saving $100 million in remaining development budget and marketing, as well as the brand perception hit of launching a hyped game that ends in a commercial disappointment, can be the correct business decision. Sunk cost fallacy is real and smart leaders make resource maximizing decisions. The truth is we don’t know the state of the game, how development went, and what was required to ship a competitive game.

Am I giving Xbox leadership a pass? Xbox leadership has proven it has poor portfolio management and capital allocation discipline. The Game Pass business model allows Xbox a degree of hand waving when justifying major acquisitions, through shifting success metrics and recurring revenue models that distort greenlighting, but has yet to prove out on a long-term basis.

If we’re not dumping the blame solely on Xbox leadership then who can I direct my internet rage towards?

AAA Game Studios

As much reddit digital ink has been spilled on Microsoft as a game publisher, I see almost no blame being put on the game studios themselves. Microsoft doesn’t want to cancel games they’ve funded development in, Microsoft wants to create profit generating assets.

It’s never been more difficult to compete as a AAA game. On the cost side you have 100+ developers and years of development, racking up 9-figure costs before shipping. These games must compete in mature spaces with incumbents who have sometimes been dominant for over a decade. With development times lasting sometimes 5+ years, the player preferences, business strategies, and trends in the industry can look foreign to the environment the game concept was greenlit in.

Game studio leadership can’t be let off the hook for conducting a slow-moving train wreck. If The Initiative had 150 people, between developers and contractors, working on the Perfect Dark Reboot, it’s up to them to ensure the unit economics and market competitiveness remain throughout development. They signed up for a development budget, timeline, and market positioning that involves producing quality and hype. Unfortunately, game teams can’t just “deliver a great game” in 2025 and hope to survive.

Microsoft doesn’t want to cancel a big investment they publicly announced at the end of 2020. It’s the game studio’s responsibility to keep their games competitive during development and give publishers confidence they will deliver a hit game, on time, and deliver returns.

Roblox, Fortnite, TikTok, and Cheap Entertainment

This leads me to the next cause to investigate, the often free alternatives to buying new video games. Roblox has an estimated 380 million monthly active users (MAU) and has effectively captured most of the under 16 market. Fortnite is constantly introducing culture-relevant content with integrations that range from Marvel crossovers to Sabrina Carpenter skins and dances. TikTok is a dopamine vending machine that drives attention spans so low other entertainment apps appear slow and boring.

One of the biggest issues with these modern attention black holes is their cost of engagement to users and its impact on developers. Yes, free entertainment isn’t a new business model, but after the bets on new content during the pandemic, we’re seeing how truly sticky and retentive the incumbents are.

Taking the roughest of estimates you can see the value proposition facing gamers today. Buying a $70 AAA game to play roughly 15 hours before quitting is an incredibly expensive cost per hour of engagement compared to the dominant games. It’s easy to see why Roblox is the preferred option for the under 16 gamers, you have over 40 million experiences to play and effectively pay nothing for playing them.

With the paradigm shifting from players churning through multiple AAA games a year to engaging in a single games-as-a-service or platform, it leaves new games less players and hours of engagement to fight over for. This coupled with the investment boom from the pandemic and you can see why so many publishers are reevaluating their current and future investments.

New Games in 2025

The issue ultimately facing Microsoft is the same across music, film, and video games: the need for new entertainment has never been lower. A lot of video game genres don’t need or can’t support new games. Incumbents such as Fortnite and League of Legends would continue forever if they had their way, and new challengers often find market size for these genres is mostly made up of single game fans that don’t try other genre entries. There isn’t a 100+ million player MOBA market, there is a 5 million player MOBA market and a 100 million player League of Legends market.

The takeaway is game funding, target markets, and long-term business strategies need to change with the times or companies risk being another footnote alongside THQ or Acclaim Entertainment in the history of games. $300 million missteps that take years to identify and course correct impact an unmeasurable amount of lives. Through layoffs and funding droughts, the game industry has lost many talented developers who likely will never return to an industry they once poured their everything into.

What are the strategies that will unlock success in 2025?

Capital efficiency:

Make AAA games with more focused scope, smaller dev teams

Most games don’t need a true open world environment, endless side quests, tons of minigames, and a laundry list of non-critical features. Games need a focused scope, budget, and development timeline while delivering an excellent core experience. Define your target market and how you win that market (differentiator) and laser focus on executing that to perfection. Create experiences exponentially above and beyond their peers that your game becomes the Nirvana Nevermind to hair metal’s excess.Portfolio Diversification Opportunities:

Play in areas where players burn through multiple titles

Don’t go head-to-head against a longtime games-as-a-service incumbent with an incremental “game X + one feature” title. Identify areas where genre fans play multiple similar games a year such as roguelike, survival, horror, and simulation instead of the deceptively lucrative MOBAs, hero shooters, tactical shooters, and battle royale genres where players are sticky to a single title.Hit-Rate Economics at Lower Costs:

Take the Innovator’s Dilemma approach to building a giant

What does Roblox, League of Legends, Counter-Strike, and many other industry giants have in common? They didn’t launch to an immediate 100 million MAU supported by a 100+ person development team. These titles weren’t created at a professional production studio but were made by small passionate teams who fiercely catered to an underserved niche, fostering a dedicated fanbase and snowballing success over time. The next League of Legends will be made by a small team that makes something adjacent to MOBA but for an underserved player segment, then increases quality and mass appeal over time. Building something truly differentiated and strengthening product-market-fit over time is how to build a games-as-a-service giant. The sooner more publishers realize this, the sooner we’ll stop seeing 100+ dev teams being laid off for throwing $300 million at the next Genshin Impact.